How to Organize Your Personal Finances Using the 50/30/20 Budgeting Method

In today’s fast-paced world, managing personal finances can often feel like a daunting task. With numerous expenses vying for your attention and the temptations of modern consumer culture, achieving a stable financial footing might seem elusive. However, one budgeting method stands out for its simplicity and effectiveness: the 50/30/20 rule. This approach, popularized by U.S. Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book “All Your Worth: The Ultimate Lifetime Money Plan,” offers a structured way to organize your financial life.

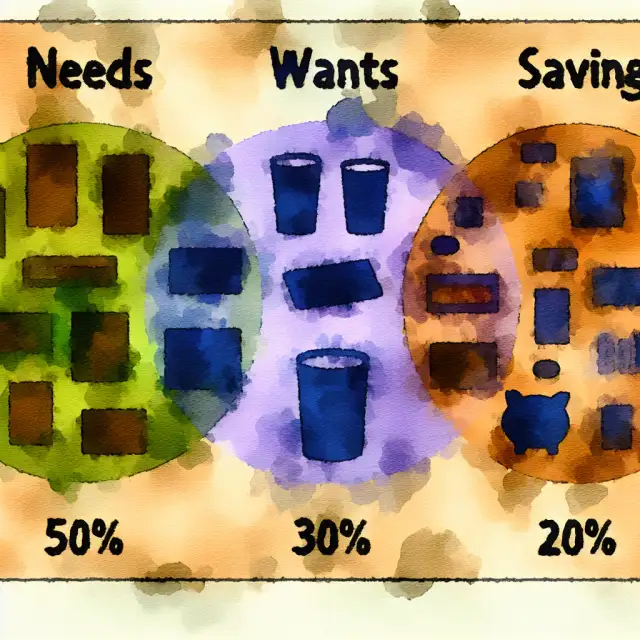

The essence of the 50/30/20 budgeting rule is its straightforward allocation of your after-tax income into three main categories: needs, wants, and savings or debt repayment. This method provides a clear framework that not only simplifies financial planning but also makes it more approachable for individuals at various stages of life. By adhering to these guidelines, you can ensure that your financial habits align with both your present needs and your long-term goals.

Budgeting, at its core, is about striking a balance between your current lifestyle and future aspirations. The 50/30/20 rule helps crystallize this balance by offering tangible percentages as targets for your spending categories. The objective is not just to micromanage every dollar but to cultivate a broader understanding of how your financial resources are being distributed. This holistic view empowers individuals to make informed decisions, steer clear from debt traps, and pursue financial independence.

As we delve deeper into each component of the 50/30/20 rule, you’ll discover practical steps to implement it in your own life. We’ll explore the rationale behind each allocation, discuss the potential benefits and pitfalls, and offer tips on how to adapt this method to your unique financial situation. With the right tools and mindset, managing your finances can become a seamless and rewarding aspect of your life.

Introduction to the 50/30/20 Budgeting Rule

The 50/30/20 budgeting rule is a simple yet effective way to manage personal finances. By categorizing expenses into needs, wants, and savings, individuals can systematically allocate their income, ensuring a balanced financial life. This method helps in prioritizing essentials, enabling one to enjoy discretionary spending without guilt and build a strong savings foundation.

The primary allure of the 50/30/20 rule lies in its simplicity, making it accessible even to those who are new to the concept of budgeting. Unlike more complex budgeting methods that require tracking every penny, the 50/30/20 rule adopts a broader approach that focuses on major expenditure categories. This makes it easier for individuals to implement and stick to over the long run. Additionally, this rule is flexible enough to adapt as life changes, such as shifts in income, family size, or financial goals.

Understanding the rationale behind the 50/30/20 allocation provides valuable insight into personal finance management. The 50% allocated toward needs ensures that you are living within your means, while the 30% for wants allows for a balanced lifestyle without excessive austerity. Meanwhile, the 20% dedicated to savings and debt repayment lays the groundwork for future financial security. This breakdown fosters an awareness of spending habits, prompting individuals to critically assess their consumption patterns and make necessary adjustments.

Understanding the 50% Needs Allocation

The first and largest component of the 50/30/20 rule is the 50% allocation for needs. These are essential expenditures that are necessary for survival and well-being. Needs typically include items such as housing, utilities, groceries, transportation, insurance, and minimum loan payments. The goal here is to ensure that half your income covers these indispensable areas, providing stability without exceeding your means.

Understanding what constitutes a “need” is crucial in effective personal finance management. Often, individuals may categorize certain wants as needs, leading to an inflated budget that threatens financial stability. When implementing the 50% allocation, it’s essential to critically evaluate each expense. Groceries fall under needs, but dining out is typically considered a want. Similarly, a basic car is a need for transportation, while a luxury car would fall into the wants category.

If your needs exceed 50% of your income, it’s a sign that adjustments are necessary. This could mean finding ways to reduce housing costs, opting for public transportation, or reassessing insurance plans. Here’s a table outlining potential cost-cutting areas within needs:

| Expense | Potential Adjustment | Outcome |

|---|---|---|

| Housing | Downsize or refinance mortgage | Reduced monthly payments |

| Utilities | Upgrade to energy-efficient appliances | Lower utility bills |

| Groceries | Use coupons/shop sales | Save money on food |

| Transportation | Carpool or use public transit | Cut down on gas and maintenance |

By keeping the needs category within its designated 50%, you ensure that your essential expenditures do not overshadow other financial priorities, allowing you to maintain a balanced lifestyle.

Understanding the 30% Wants Allocation

The 30% allocation for wants in the 50/30/20 rule encompasses all discretionary spending. This category includes expenses that enhance your lifestyle but are not essential for survival. Examples of wants include dining out, entertainment, vacations, hobbies, and personal shopping. Allocating 30% of your income to this category promotes a healthy balance between financial responsibility and enjoying life.

Wants are often the most subjective category in personal finance management. What one person deems essential for happiness, another might view as an unnecessary luxury. To navigate this, it’s helpful to categorize and monitor these expenses through periodic reviews. Establishing a clear distinction between needs and wants helps prevent overspending that could potentially derail financial goals.

Although the 30% allocation allows for some indulgence, moderation is crucial. It’s important to remember that exceeding the 30% mark can impact your ability to meet savings and debt repayment goals. Prioritizing and setting limits can ensure your discretionary spending aligns with your long-term aspirations. For instance:

- Limit dining out: Consider setting a fixed monthly budget for dining out and try meal prepping or cooking at home more often.

- Be mindful of digital subscriptions: Evaluate whether you are using all your subscribed services. Cancel those that no longer provide value.

- Opt for cost-effective entertainment: Explore free or low-cost community events instead of high-priced outings.

By consciously managing your wants, you can indulge responsibly while safeguarding your financial future.

Understanding the 20% Savings and Debt Repayment Allocation

The final component of the 50/30/20 budgeting method is the 20% allocation dedicated to savings and debt repayment. This section of your budget focuses on building a financial cushion for future needs while addressing existing debts. Contributing 20% of your income to this category is integral to long-term financial planning and security.

This allocation typically encompasses several key financial priorities, including:

-

Emergency fund: Aim to accumulate 3-6 months’ worth of living expenses to cover unexpected events like job loss, medical emergencies, or major repairs.

-

Retirement savings: Contribute to retirement accounts such as 401(k)s or IRAs to ensure financial independence in your later years.

-

Debt repayment: Focus on clearing high-interest debt like credit cards. Once managed, shift attention to other obligations until fully paid off.

Allocating 20% towards saving and debt repayment requires discipline and consistency. Automating transfers to savings accounts or utilizing employer-sponsored retirement plans can help in maintaining regular contributions. Balancing the savings goals with debt repayment is essential. For instance, you might decide to allocate a larger portion towards debt initially and then gradually increase savings contributions as debts diminish.

Consistent contributions to savings and debt reduction not only build financial resilience but also provide peace of mind. Securing your financial foundation allows you to pursue opportunities and weather economic downturns with greater confidence.

Steps to Implement the 50/30/20 Rule in Personal Finance

Applying the 50/30/20 budgeting rule in your financial life requires a degree of commitment and a step-by-step approach. Here is a guide on how to implement this budgeting strategy effectively:

Step 1: Calculate your after-tax income

Begin by determining your total take-home pay after taxes. This includes all sources of income like salary, freelance work, or rental income. Your after-tax income forms the baseline for the 50/30/20 allocations.

Step 2: Categorize your expenses

List all your monthly expenses and classify them into the categories of needs, wants, and savings or debt repayment. Evaluate your needs based on essentials that require attention, from housing to insurance and groceries.

Step 3: Set target allocations

Align the categorized expenses with their respective percentages: 50% for needs, 30% for wants, and 20% for savings or debt repayment. Identify areas where adjustments can be made to meet these targets if there are discrepancies.

Step 4: Regularly track and review

Monitoring your expenses is crucial. Use tools or apps to track spending, ensuring you adhere to your budget every month. Regular reviews will help identify trends, problem areas, or categories where savings are possible.

Step 5: Adapt to changes

Life is unpredictable, and budgets may need adjustments over time. Remain flexible and tweak allocations as you experience changes in income, lifestyle, or financial goals. The key is to maintain a balanced approach while honoring the overarching 50/30/20 principles.

By systematically applying these steps, you will not only manage day-to-day financial demands but also lay the groundwork for a secure future.

Benefits of Using the 50/30/20 Budgeting Method

Embracing the 50/30/20 budgeting method offers numerous benefits that can greatly enhance your financial management skills and overall well-being. Here’s how this approach can be advantageous:

Clarity and simplicity

The 50/30/20 rule simplifies budgeting by providing clear spending limits for key categories: needs, wants, and savings. This clarity eliminates uncertainty and streamlines decision-making regarding expenses.

Flexibility and adaptability

Unlike rigid budgeting models, the 50/30/20 rule allows for organic adjustments in line with changes in income or financial circumstances. Adapting to life’s dynamics is integral to maintaining financial stability while meeting evolving goals.

Enhanced saving culture

By allocating a specific 20% towards savings and debt repayment, this budgeting method instils a commitment to saving. It emphasizes both short-term financial protection and long-term financial growth.

Balance between present and future

The allocation for wants ensures that individuals can enjoy life’s pleasures without guilt while still prioritizing financial safety nets.

Foundation for financial independence

Adhering to these budgeting guidelines offers a pathway towards financial independence. With disciplined savings and prudent spending, the 50/30/20 rule ensures that individuals progress consistently towards a debt-free and secure future.

When implemented thoughtfully, the benefits of this budgeting method extend beyond numbers, helping individuals focus on priorities, cultivate mindful spending habits, and secure financial freedom.

Common Mistakes to Avoid with the 50/30/20 Budget

While the 50/30/20 budgeting rule offers an effective framework for managing finances, common mistakes can derail its success. Here are pitfalls to watch out for:

Misclassifying wants as needs

Distinguishing between needs and wants is a common hurdle. An inflated needs category resulting from misclassification could strain finances. Regularly reassess and adjust these classifications to stay on track.

Ignoring expense tracking

Failure to track expenses undermines budgeting efforts. Without monitoring, it’s challenging to identify discrepancies, assess trends, and apply necessary corrections. Utilize tools or manual systems to diligently track expenditures.

Neglecting to adapt

Life’s financial demands change frequently. Sticking rigidly to the original allocations may not reflect current realities. Be open to reviewing and revising your budget in response to changing personal circumstances and inflation.

Presumptive income allocations

Assuming a consistent income can lead to overzealous spending. Plan for fluctuations, ensuring adequate financial buffer zones to accommodate variances in income or unexpected expenses.

Overlooking small expenses

Numerous small expenses can accumulate and disrupt budgets. Keep an eye on these seemingly minor spending habits and incorporate them into your plan to avoid inadvertently exceeding your allocations.

Avoiding these mistakes enhances the effectiveness of the 50/30/20 method and ensures your financial planning is robust, responsive, and result-oriented.

Adapting the 50/30/20 Rule to Different Income Levels

The 50/30/20 rule serves as a flexible blueprint that can be adapted to various income levels. Here’s how you can tailor the approach:

Low-income scenarios

In situations where expenses heavily outweigh income, prioritize critical needs and find areas to minimize costs. Consider increasing the savings allocation gradually, especially in emergency fund creation, as budgetary relief occurs.

Middle-income earners

This group can largely adhere to standard 50/30/20 division, with greater discretion in wants. Prioritize clearing debts and enhancing savings, taking advantage of employer-matched retirement programs.

High-income households

Higher income provides more extensive choices. Maintain standard allocations or consider elevating savings percentages. Maximize contributions to tax-deferred accounts, invest strategically, and focus on philanthropic endeavors through the wants portion.

No matter the income level, the principles of effective money management remain constant: budget according to means, prioritize future financial needs, and ensure that present consumption does not overshadow future stability.

Tools and Apps to Simplify Budget Management

Successfully managing finances requires effective tools and apps that align with your goals and preferences. Consider incorporating the following into your financial routine:

Mint

A popular integrative app that consolidates all accounts, tracks expenses, and provides budgeting tools. Its automatic categorization of expenses simplifies the adherence to 50/30/20 allocations.

YNAB (You Need A Budget)

YNAB emphasizes proactive financial management and accountability. Its unique approach encourages you to allocate funds according to expenses as they arise, helping to define spending priorities.

PocketGuard

This app focuses on providing a clear picture of available funds after bills and daily expenses. It assists in staying within the 50/30/20 budget by showing what you can safely spend.

Goodbudget

A digital adaptation of the traditional envelope system. It sets spending limits for each category, reinforcing discipline as aligned with the 50/30/20 breakdown.

Personal Capital

For users with investment priorities, Personal Capital offers insights into spending, budgeting, and investment performance. Its focus on integrated personal financial management is a valuable asset for those with complex financial structures.

Selecting the right tool or app amplifies budgeting efforts, providing convenience, reliability, and insights that drive progress and accountability.

How to Adjust the 50/30/20 Rule During Economic Changes

Economic fluctuations necessitate agility in financial management. Here’s how to navigate the 50/30/20 rule when faced with economic challenges:

Implement a buffer zone

During economic downturns, increase savings contributions if possible, channeling more income to bolster emergency funds. This buffer ensures preparedness for unforeseen economic strain.

Review and adjust allocations

Evaluate spending to identify unnecessary expenditure in the wants category. Temporary constraints here might free up resources for vital needs or savings, ensuring continued financial stability.

Reassess financial goals

Economic changes might delay initial financial goals. Temporarily adjust contributions towards retirement or other savings, focusing on debt management first as interest rates potentially surge.

Leverage available resources

Explore community or government assistance, refinancing options, or employer benefits that could offset pressures on needs.

By remaining responsive and strategic, individuals can maintain financial integrity and adapt their budgets effectively, even amidst economic volatility.

Conclusion: Long-term Financial Success with the 50/30/20 Method

Implementing the 50/30/20 budgeting rule in your personal finance management promotes stability and proactive financial planning. By adhering to its principles, individuals achieve a balanced approach that caters to present enjoyment and future security.

The simplicity and flexibility of this budgeting method empower individuals across all income levels to take control of their financial destinies. Whether breaking free from debt, building savings, or navigating economic changes, the 50/30/20 rule offers insightful guidance.

Ultimately, the key to long-term financial success lies in consistent application and willingness to adapt. With these components in place, the 50/30/20 rule transforms from a budgeting tool to a lifestyle, guiding you towards a more secure and fulfilling financial journey.

FAQs

1. What if my expenses exceed the 50/30/20 budget allocations?

If your expenses are exceeding the set allocations, reassess and prioritize your needs over wants, and look for ways to reduce or cut non-essential spending.

2. Can I use the 50/30/20 rule if I have irregular income?

Yes, individuals with irregular income can use the rule by calculating averages and focusing on percentage allocations rather than fixed amounts. Creating a buffer fund for months with lower income can also help maintain the budget.

3. How soon can I see results after implementing this budget?

The timeline for results can vary. However, consistent application of the rule should yield noticeable benefits within a few months, especially in reduced stress and increased savings.

4. Is the 50/30/20 rule suitable for debt repayment other than credit card debt?

Yes, the 20% of income allocated to savings and debt repayment can be adjusted to tackle various types of debt, such as student loans or medical bills, especially those with high-interest rates.

5. What happens if my financial goals change?

The 50/30/20 rule is highly adaptable. If your financial goals change, adjust the allocations across categories to reflect your new priorities while maintaining the overall budgeting framework.

Recap

The 50/30/20 budgeting method offers a structured yet flexible approach to personal financial management. It segments spending into needs (50%), wants (30%), and savings/debt repayment (20%), promoting clarity and simplifying budget tracking. This method is adaptable to various income levels and provides resilience during economic shifts. Utilizing financial apps can enhance adherence to the rule and help monitor progress, while avoiding common budgeting pitfalls ensures long-term success.

References

-

Warren, E., & Tyagi, A. W. (2005). All Your Worth: The Ultimate Lifetime Money Plan. Free Press.

-

Fisher, J. D., & Anong, S. T. (2012). “Budgeting the 50/30/20 way—More practice than theory,” Journal of Financial Counseling and Planning.

-

Solomon, J. (2020). “Budgeting Tips for Every Lifestyle,” Financial Planning Magazine.