Introduction to Responsible Credit Management

In today’s modern financial landscape, credit has become an indispensable tool for achieving personal and professional goals. From buying a home to funding education, and even investing in business ventures, credit plays a critical role in facilitating opportunities. However, with great power comes great responsibility. Understanding how to use credit strategically and responsibly is essential for long-term financial success. Credit should not merely be viewed as a way to access money but as an integral part of one’s financial strategy.

Responsible credit management is pivotal in ensuring your financial health remains robust over time. Misuse of credit can lead to a downward spiral of debt, affecting not only your peace of mind but also your financial reputation. On the flip side, savvy credit use can bolster your credit score, reduce borrowing costs, and open up new financial avenues. By integrating responsible credit practices into your financial routine, you can establish a solid foundation that supports your long-term objectives.

One often underappreciated aspect of credit management is its inherently dynamic nature. Economic conditions, spending habits, and life events all play a role in shaping how credit should be managed. As such, many strategies must be flexible to adapt to these changes while adhering to basic principles of financial prudence. The key to mastering credit lies not only in understanding how it works but also in knowing how to apply that knowledge in ways that evolve with your life and circumstances.

In this guide, we will explore various facets of strategic credit use, delving into the mechanics of credit scores, choosing appropriate credit products, maintaining a healthy credit utilization ratio, and avoiding common pitfalls. Our goal is to equip you with the knowledge and tools you need to employ credit effectively and responsibly while ensuring your financial journey remains smooth and prosperous.

Understanding Credit Scores and Their Impact

An individual’s credit score is a three-digit number that significantly influences their ability to access financial products. It’s based on the credit history contained in your credit report and serves as an indicator of your credit-worthiness to potential lenders. The most well-known credit scoring models are FICO and VantageScore, ranging from 300 to 850. The higher the score, the more trustworthy you appear in the eyes of lenders.

Credit scores are calculated using several factors, each contributing a percentage to the total score. The most significant component is payment history, which accounts for about 35% of your score. This is followed by amounts owed, constituting 30%, which evaluates your outstanding debts and credit utilization ratio. Other factors include the length of credit history (15%), new credit (10%), and credit mix (10%), which looks at the variety of credit accounts you hold.

Understanding the impact of your credit score goes beyond just lending; it can affect your employment opportunities and the insurance premiums you pay. Employers and insurance companies often use credit scores as a measure of trustworthiness and risk respectively. Thus, managing your credit responsibly not only influences your borrowing capacity but also extends to other areas of life. A solid credit score can translate into better financial terms and conditions, thereby fostering long-term financial success.

The Importance of Setting Clear Financial Goals

Establishing clear financial goals is a fundamental step in responsible credit management. Without a defined set of objectives, it’s easy to fall into the trap of impulsive spending and over-leveraging credit. Goals provide a roadmap that guides your financial decisions and helps keep your credit use aligned with your overall plan.

The first step in setting financial goals is to distinguish between short-term, medium-term, and long-term objectives. Short-term goals might include paying off credit card debt, while medium-term objectives could involve saving for a down payment on a house. Long-term goals often encompass retirement savings or establishing an investment portfolio. By categorizing your goals this way, you can prioritize accordingly, ensuring that credit use is optimized to meet these milestones effectively.

Setting goals also involves devising actionable steps to achieve them. This might include creating a budget, reducing unnecessary expenses, or setting up an automatic savings plan. When your financial goals are clear and backed by a practical plan, your credit usage is naturally disciplined and strategic. This synergy between planning and action builds a robust financial framework that enhances your ability to achieve lasting success.

How to Choose the Right Credit Products for Your Needs

Expanding your credit portfolio requires careful consideration of the available options and selecting the ones that best suit your needs. With numerous credit products on the market, ranging from credit cards to loans, it’s crucial to make informed decisions that align with your financial goals.

To choose the right credit products, begin by assessing your current financial situation and identifying your specific requirements. Are you looking to consolidate debt, finance a large purchase, or build your credit history? Understanding your underlying needs will help narrow down the options and make the selection process more straightforward.

Consider the features and benefits of different credit products before making a decision. This includes interest rates, fees, rewards programs, credit limits, and repayment terms. Here’s a simple table to compare these factors:

| Product Type | Interest Rate | Fees | Rewards |

|---|---|---|---|

| Credit Cards | Variable | Annual, Late | Cashback, Miles |

| Personal Loans | Fixed/Variable | Origination | N/A |

| Home Equity Lines | Variable | Closing, Late | N/A |

By examining these factors, you can better evaluate which product offers the most advantages while aligning with your financial strategy. Opt for products that offer favorable terms and enhance your ability to manage credit effectively, keeping in mind any long-term implications such as impact on credit scores and potential financial risks.

Strategies for Maintaining a Healthy Credit Utilization Ratio

Maintaining a healthy credit utilization ratio is a pivotal element in strategic credit use. Credit utilization refers to the percentage of available credit you are using at any given time. It is a major component of your credit score, with a recommended utilization rate of less than 30%.

To manage your credit utilization effectively, start by keeping track of your credit limits and outstanding balances. Regular monitoring helps you stay aware of your current utilization rate and make adjustments as needed. Utilizing budgeting tools or credit monitoring services can assist in maintaining low utilization levels.

Another strategy involves spreading out expenses across multiple credit accounts rather than concentrating charges on a single card. This method helps keep individual account utilization low. Additionally, consider requesting credit limit increases on accounts with responsible usage history, which raises your overall credit limit and lowers the utilization ratio.

Finally, paying down outstanding balances is crucial in managing your credit utilization effectively. Prioritize paying off high-interest debt and avoid accumulating new charges unless necessary. By staying vigilant about your credit utilization, you not only maintain a healthy credit score but also optimize your financial resources for future success.

The Role of Timely Payments in Building Credit

Timely payments are the bedrock of a healthy credit profile. Payment history carries the most weight in determining your credit score and reflects your reliability as a borrower. Lenders want assurance that you are capable of repaying borrowed funds on schedule, which is why a good payment history is crucial.

To ensure timely payments, set up automatic payments or reminders for your bills. Many financial institutions offer auto-pay options that can be linked to your checking account to cover the minimum payment each month. This not only prevents late payments but also helps you avoid late fees and penalty interest rates.

If facing a situation where you might miss a payment, proactive communication with your lender is advisable. Many lenders offer hardship programs or grace periods that can provide temporary relief while safeguarding your credit score. By addressing potential payment issues before they become delinquencies, you protect your credit integrity.

Consistently making on-time payments cultivates positive credit behavior over the long term. It builds trust with lenders and can lead to expanded credit opportunities, lower interest rates, and better terms. By emphasizing timely payments, you solidify the foundation of responsible credit use.

Avoiding Common Credit Pitfalls and Traps

Even with careful planning, it’s easy to find oneself entangled in common credit pitfalls. Recognizing these traps and knowing how to avoid them is essential for anyone aiming for long-term financial success.

One of the primary pitfalls is carrying a balance on credit cards when it can be avoided. The compounding high-interest rates can lead to mounting debt and an overall increase in financial strain. Always strive to pay off your balance each month to prevent incurring interest charges.

Another common trap is taking on too many credit accounts at once, which can lead to overspending and difficulty managing payments. Each credit inquiry can impact your score, and opening multiple accounts in a short time can signal financial instability to lenders. Instead, focus on utilizing and managing a limited number of accounts responsibly.

Finally, avoid the temptation of minimum payments. While paying the minimum might seem manageable in the short term, it significantly extends the time it takes to pay off debt and increases the total interest paid. Planning for more substantial payments each month is a more effective strategy in reducing debt quickly.

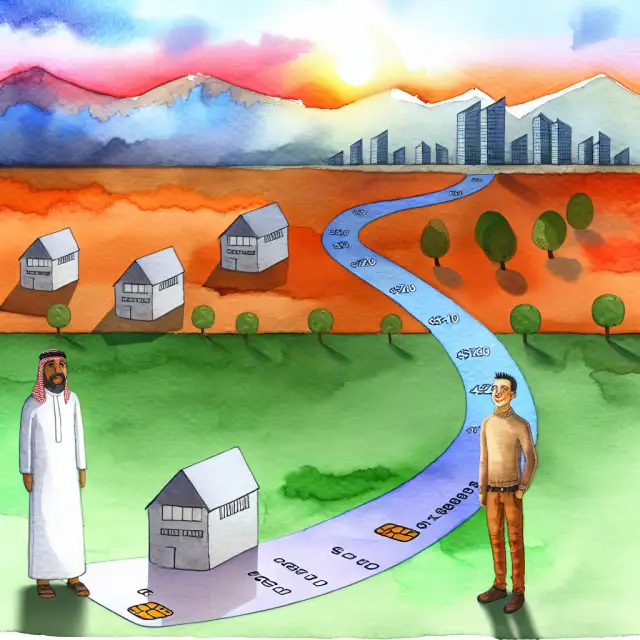

Leveraging Credit for Investment Opportunities

Credit, when used thoughtfully, can be a powerful tool for creating wealth and investing in future opportunities. By leveraging credit, you can tap into additional resources that might otherwise be unavailable, allowing for strategic investments in assets that appreciate over time.

Real estate investment is one area where credit can be highly beneficial. Mortgage loans make it possible to acquire property, which can provide rental income or long-term appreciation. With careful planning and due diligence, leveraging credit for real estate can enhance your investment portfolio substantially.

Using credit to invest in education is another strategic choice. Student loans, if managed well, enable you to gain skills and qualifications that increase your earning potential. Viewing education as an investment rather than an expense can yield dividends in career advancement and financial security.

However, exercising diligence in leveraging credit for investment is essential. Over-leveraging can lead to significant financial strain and potential loss if the investments don’t yield the expected returns. Therefore, it’s crucial to approach such opportunities with a clear understanding of the potential risks and rewards.

Monitoring Your Credit Regularly to Avoid Fraud

Regular monitoring of your credit report is vital in detecting discrepancies and preventing fraudulent activities. As identity theft becomes increasingly sophisticated, keeping an eye on your credit is more important than ever to safeguard your financial health.

Start by obtaining your credit report from the three major credit bureaus—Experian, Equifax, and TransUnion—at least once a year. Review the reports carefully to identify any unfamiliar accounts or inquiries that could indicate fraudulent activity. By checking your credit regularly, you can spot issues early and take corrective action promptly.

Many credit card companies offer free credit monitoring services, providing alerts when significant changes occur in your credit profile. Signing up for these services adds an extra layer of security and enables you to respond quickly to potential threats.

Additionally, consider placing a fraud alert or credit freeze on your credit file if you suspect identity theft. These measures make it more difficult for unauthorized parties to open accounts in your name, offering peace of mind and added protection.

Balancing Debt and Savings for Optimal Financial Health

Balancing debt and savings is crucial for maintaining overall financial health. While credit can provide funds for necessary expenses and investments, an overemphasis on borrowing at the expense of saving can jeopardize your financial stability.

To strike the right balance, prioritize establishing an emergency fund that covers three to six months of living expenses. This fund acts as a financial buffer, reducing reliance on credit in case of unexpected events such as medical emergencies or job loss.

Evaluate your debt-to-income ratio (DTI) regularly. This metric compares your total monthly debt payments to your income and is used by lenders to assess borrowing risk. A low DTI indicates a healthy balance between debt and income, suggesting capacity to further save and invest.

Simultaneously, commit to retirement savings plans, such as a 401(k) or IRA. Diversifying your savings strategy ensures that while you manage debts responsibly, you’re also building a nest egg for the future. By maintaining a balanced approach to credit and savings, you create a sustainable financial model that supports long-term success.

Conclusion: Building a Sustainable Credit Strategy for the Future

Building a sustainable credit strategy is a continuous process that requires diligence, knowledge, and a forward-thinking approach. As financial landscapes evolve, so too must your strategies to ensure that you’re leveraging credit opportunities effectively while managing risks.

Achieving long-term financial success through strategic credit use means understanding the intricate details of credit management, from how credit scores impact financial health to choosing the right credit products for your needs. A robust strategy incorporates responsible habits such as timely payments, low credit utilization, and regular monitoring for any discrepancies or fraudulent activities.

While credit can be a powerful ally in achieving financial goals, moderation is key. Avoid common pitfalls by being mindful of unnecessary debts and focusing on creating a healthy balance between debt and savings. Leveraging credit for investments can also expedite wealth accumulation, provided that due diligence is exercised.

Ultimately, a sustainable credit strategy isn’t about perfection; it’s about making informed decisions that align with your long-term financial objectives. It requires adaptability, perseverance, and continuous learning, setting the stage for enduring financial security and success.

Recap

- Credit is a crucial tool for financial opportunities but requires strategic and responsible management.

- Understanding how credit scores are calculated and their broader impact is essential in shaping financial strategy.

- Clear financial goals guide credit use, ensuring it aligns with both short-term and long-term objectives.

- Choosing the right credit products involves evaluating features such as interest rates, fees, and potential rewards.

- Maintaining a low credit utilization ratio is paramount for a healthy credit profile.

- Timely payments build trust with lenders and form a primary component of a strong credit score.

- Avoiding credit pitfalls helps prevent unnecessary debt accumulation and financial strain.

- Leveraging credit for investments, such as real estate or education, can enhance financial growth.

- Regular credit monitoring guards against fraud and helps maintain credit integrity.

- Balancing debt with savings ensures financial resilience and promotes long-term wealth accumulation.

FAQ

-

What is the most important factor affecting my credit score?

Payment history is the most critical factor, accounting for 35% of your credit score. It reflects your past ability to manage and repay debts. -

How can I lower my credit utilization ratio?

Pay down outstanding balances, and consider spreading expenses across multiple credit cards or requesting higher credit limits on well-managed accounts. -

What should I focus on when choosing a credit card?

Look for competitive interest rates, low fees, and reward programs that align with your spending habits and financial goals. -

How can I avoid impulse spending with credit?

Set clear financial goals and create a budget that prioritizes needs over wants. Monitoring expenses regularly also helps you stay within limits. -

Is it beneficial to have multiple credit card accounts?

Multiple accounts can be beneficial if managed well; they can improve your credit utilization rate. However, avoid opening too many accounts at once. -

What steps should I take if I suspect credit card fraud?

Immediately report any suspicious activity to your credit card issuer, and consider placing a fraud alert on your credit file with the major credit bureaus. -

How often should I check my credit report?

At least once a year, but more frequently if possible, to monitor for any discrepancies or potential fraudulent activities. -

How can credit enhance my investment opportunities?

Credit can provide the means to invest in appreciable assets like real estate or education, elevating your overall wealth strategy with thoughtful planning.

References

- “The Importance of a Good Credit Score,” by FICO Score, available at FICO Score.

- “Understanding Your Credit Report and Credit Score,” by TransUnion, available at TransUnion.

- “Guide to Choosing Credit Cards,” by Money Management International, available at Money Management International.