Understanding your finances will benefit from having strong math skills, such as the ability to convert percentages to decimals and back again. You must understand the relationship between decimals and percentages whether you are mentally estimating amounts quickly, using a calculator, or modeling your car loan on a spreadsheet.

Subtract 100

The most common way to describe and advertise interest rates is as a percentage. But you must change those numbers to decimal format if you intend to use them in calculations. To do that, divide the quantity by 100.1

For instance, divide 75 by 100 to represent 75 percent as a decimal.

75 ÷ 100 = .75

You can perform quick calculations online with the help of search engines like Google and Bing, or if you prefer, launch your preferred calculator app. Enter the expression you’re attempting to solve into the search field of a search engine to perform the calculation. Enter “75/100” as an example.”

To the left of the decimal point

By moving the decimal two places to the left, you can also convert a quoted percentage to decimal format.

Note

If you don’t see a decimal, just visualize it being at the end or very right of the number. If it makes sense, think of the decimal as being followed by two zeros (75 would be 75.00).

For instance, to convert 75% to decimal format, place the decimal point before the number.

Dot75 is equivalent to 75%.

You’ll be able to instantly perform this in your head after practicing it several times until it becomes second nature.

You will still only shift the decimal two places for more complicated numbers. More examples are provided below:

100% equals 1

1 point equals 150 percent.

Dot75435 is equal to 75.435

5% equals . 005

For instance, APY Earnings

Assume that your savings account earns an annual percentage yield (APY) of 1.25% from your bank. If you put $100 down, how much will you make over the course of a year?

To determine, multiply the interest rate’s result by the amount of your deposit after converting it to decimal form.

1.25 multiplied by 100 yields .0125.

125 * $100 = $1.25.

Every $100 you deposit will earn you $1.25 annually.

Note

To multiply numbers in a spreadsheet or search engine, use the asterisk (or *) symbol.

Example: Savings on purchases

Let’s say you want to purchase a $45.00 item that is currently 30% off. What percentage of the sale price would you pay, and how much would you save?

30 ÷ 100 = .30.

30 times $45 equals savings of 13pt.

$31.50 is the sale price, or 45 – $13.50.

In exchange for the item, you would pay $31.50 and save $13.50.

Decimal to percentage conversion

As you might have guessed, you should simply reverse the process described above if you want to convert a number from decimal to percentage format.

100 times is a multiple

A simple method is to multiply a decimal number by 100.

Example: Multiply .75 by 100 to get its percentage conversion.

075 divided by 100 equals 100%.

Decimal Point: Right-Shift it

By moving the decimal point two places to the right, you can also convert a decimal number into a percentage.

Move the decimal point after the fifth place to convert .75 to a percentage, for instance.

75 equates to 75%.

The overall picture

Whether it’s for the better or worse, sometimes financial calculations like this only give you a ballpark estimate of how much you’ll spend or earn, but that figure is still helpful for making quick, broad judgments.

The methods above are accurate for converting percentages to decimals, but it’s crucial to understand what to do with the result once you’ve done so. The following illustration demonstrates how you can make mistakes when performing basic dollar amount calculations.

Assume you’ll take out a $100,000 loan for a 30-year mortgage to buy a house, with an interest rate of 6% annually. How much will you spend annually on interest?

To get a rough, but not the exact answer, convert the interest rate to decimal format and multiply the result by the amount you borrow:

6 ÷ 100 = 0.06.

0.06 * $100,000 = $6,000.

Unless you use an interest-only loan, you won’t pay exactly $6,000 in interest each year. 4 The actual amount for the majority of fixed-rate mortgages would be closer to $5,966.59 for the first year.

With typical home and auto loans, you typically settle the debt over time with constant monthly payments. Your loan balance is reduced in part with each payment, and the remaining amount is used to pay the interest.

There will only be a brief time, just the first month, where you owe the full $100,000 as you’re paying off the loan balance. After that, your monthly debt will decrease and your interest costs will follow suit. Amortization is the term for that process.

Note

You can learn how to create an amortization table if you want to determine the precise amount of interest payments on a loan.

Questions and Answers (FAQs)

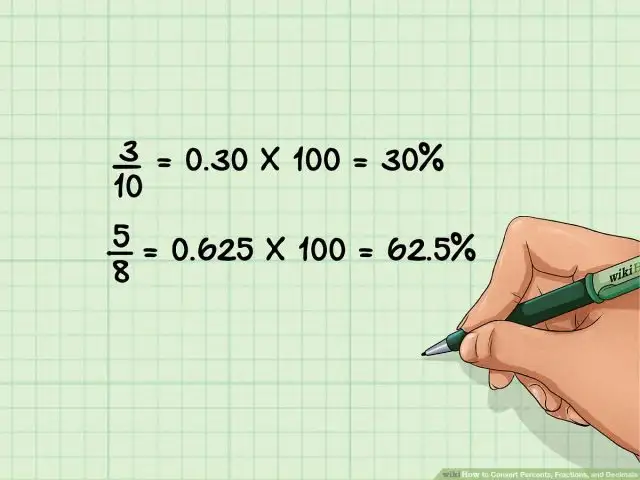

How is a fraction converted to a percent?

A fraction must first be converted to a decimal by dividing the top number by the bottom number in order to be converted to a percent. The decimal should then be shifted two numbers to the right to become a percent. For instance, 3/4 becomes 3 4 = 0.75, or 75%.

How is a decimal rounded to the nearest tenth of a percent?

The decimal representation of a tenth of a percent is 0.001. When rounding a number with more than three digits following the decimal, one should consider the fourth digit (the hundredth of a percent). You round the tenth of a percent up if that number is five or higher. Rounding down and maintaining the tenth of a percent as-is is done if the number is four or less. For instance, 0.0015 would become 0.002, whereas 0.0014 would become 0.001.