Introduction to the Relationship Between Debt and Mental Health

In today’s fast-paced society, economic challenges are a significant concern for many individuals. Among these challenges, debt has emerged as a prevalent issue, touching the lives of millions worldwide. The consequences of debt extend beyond financial obligations and have a profound impact on mental health. Understanding the complex relationship between debt and mental health is crucial for developing strategies that address both financial and emotional well-being.

Debt is more than just a number on a credit report; it’s a significant stressor that affects various aspects of life. The responsibility of managing debt can lead to a range of mental health challenges, including anxiety, depression, and insomnia. It is essential to recognize that financial stress does not discriminate, affecting people from all walks of life, regardless of age, gender, or socioeconomic status.

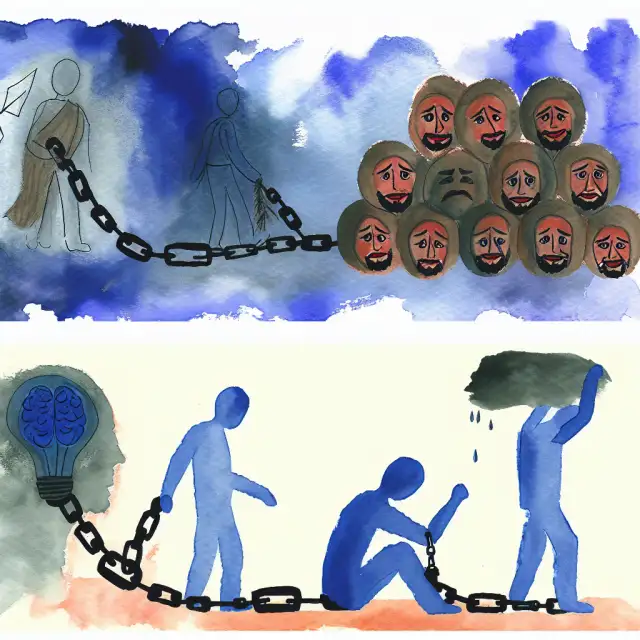

The link between debt and mental health is bidirectional. While financial difficulties can exacerbate mental health issues, existing mental health problems can also lead to poor financial decisions and increased debt. This cyclical nature makes it imperative to address both areas to break the cycle and promote overall well-being. Understanding the psychological effects and manifest symptoms of debt-related stress is the first step in addressing this vicious cycle.

Breaking free from the grips of debt requires not only financial recovery but also mental health recovery. By acknowledging the interaction between these two elements, individuals can better navigate their paths to wellness. In this article, we will explore the impacts of debt on mental health, provide practical advice for managing debt-related stress, and suggest strategies for long-term financial and mental well-being.

The Psychological Effects of Being in Debt

Debt can impose significant psychological effects, influencing an individual’s mental state and behavior. Financial obligations can lead to a constant cycle of worry and pressure, which affects various facets of life. Understanding these psychological effects is crucial to mitigating their impacts and promoting healthier mindsets.

First and foremost, debt often triggers anxiety and stress. Those burdened by financial obligations may feel overwhelmed by their inability to meet payments, leading to constant worry about their financial future. This anxiety can manifest in various ways, such as restlessness, tension, and difficulty concentrating, ultimately affecting an individual’s ability to perform daily tasks effectively.

Furthermore, prolonged financial strain may result in feelings of guilt and shame. Society often attaches stigmas to indebtedness, leading individuals to internalize their financial struggles as personal failures. This can erode self-esteem and increase feelings of worthlessness, potentially spiraling into more severe mental health conditions such as depression.

Debt-related stress also affects interpersonal relationships. The strain of managing debt can lead to arguments and tension within families or partnerships, as the stress of financial insecurity spills over into personal interactions. This can result in social withdrawal and isolation as individuals avoid discussing their financial situation, further exacerbating feelings of loneliness and despair.

Signs and Symptoms of Debt-Related Stress and Anxiety

Recognizing the signs and symptoms of debt-related stress and anxiety is vital for individuals to seek appropriate help and interventions. These symptoms can present both physically and mentally, affecting individuals’ overall health and quality of life. By identifying these warning signs, individuals can take proactive steps toward managing their stress effectively.

One common symptom of debt-related stress is persistent worry or obsessiveness over financial matters. Individuals may find themselves constantly calculating their expenses, monitoring their bank accounts, or fretting over upcoming payments, which can lead to cognitive fatigue and burnout.

Physical symptoms are also prevalent in individuals experiencing debt-related stress. Stress can manifest in headaches, muscle tension, insomnia, and changes in appetite. The body’s physical response to stress can lead to long-term health issues if not addressed promptly.

Emotionally, debt-related stress can induce mood swings, irritability, and feelings of hopelessness. These symptoms may contribute to a withdrawal from social activities and a lack of motivation to engage in previously enjoyable activities. Addressing these symptoms early on can prevent more severe mental health issues from developing.

Statistics on Debt and Mental Health: A Global Overview

The global landscape of debt and its impact on mental health is staggering. Statistics reveal that debt is a critical issue affecting millions worldwide, with significant mental health implications. Understanding these figures highlights the need for collective efforts to address this crisis.

According to studies, a significant percentage of individuals with debt report mental health challenges. For instance, individuals with high levels of debt are more than twice as likely to experience depression or anxiety than those with low levels of debt. The following table presents some statistics on debt and mental health across various regions:

| Region | Debt Impact on Mental Health (%) | Population Affected (Millions) |

|---|---|---|

| North America | 35 | 40 |

| Europe | 28 | 30 |

| Asia | 22 | 45 |

| Australia | 30 | 5 |

These statistics emphasize the global reach of debt-related mental health issues and highlight the importance of addressing both financial and mental health concurrently. The pervasive nature of debt-related stress underscores the necessity for systemic changes, including better access to mental health support and financial education.

The Vicious Cycle: How Debt Can Exacerbate Mental Health Issues

Debt and mental health issues exist in a cyclical relationship, where each exacerbates the other. This vicious cycle can trap individuals, making it difficult to break free and achieve both financial and emotional well-being. Understanding this cycle is essential to developing effective interventions and support systems.

Financial stress can trigger or worsen mental health issues, such as anxiety and depression. When individuals are consumed by their financial obligations, they may neglect self-care practices, leading to deteriorating mental health. This can manifest in poor decision-making and impulsivity, which may result in further financial strains such as overspending or ignoring bills.

Conversely, existing mental health issues can contribute to financial difficulties. Conditions like depression can lead to a lack of motivation or energy, affecting an individual’s ability to manage finances adequately. This may result in missed payments or accruing additional debt, perpetuating the cycle of stress and financial insecurity.

To disrupt this cycle, comprehensive strategies are necessary. These can include mental health treatment, financial counseling, and supportive resources that address both aspects simultaneously. By focusing on both debt management and mental health, individuals can work towards breaking the cycle and achieving lasting recovery.

Case Studies: Real-Life Impacts of Debt on Individuals’ Mental Health

Real-life case studies provide insight into how debt can profoundly affect individuals’ mental health, highlighting the personal stories behind the statistics. These narratives underscore the importance of addressing both financial and mental health to achieve holistic recovery.

Consider the case of Sarah, a young professional who accumulated significant student debt. The mounting stress of repayment led to anxiety and insomnia, impacting her performance at work. Seeking help, Sarah began therapy and enrolled in a financial literacy program, which equipped her with tools to manage her debt effectively while improving her mental health, showcasing the intersection of financial and emotional healing.

Another example is John, a small business owner who faced bankruptcy. The financial collapse took a toll on his mental health, leading to depression and withdrawal from family and social activities. Through family support and professional counseling, John was able to reframe his situation and develop a plan to rebuild his business, illustrating the importance of a supportive network in overcoming debt stress.

These case studies highlight that while debt can have severe mental health implications, with the right support and resources, individuals can overcome these challenges. They reinforce the necessity for integrated approaches that address both financial and psychological aspects.

Practical Tips for Managing Debt-Related Stress

Managing debt-related stress requires a multifaceted approach that combines practical financial strategies with stress-reduction techniques. By implementing these practical tips, individuals can alleviate financial stress and promote a healthier mental state.

-

Create a Budget: Develop a comprehensive budget that outlines income, expenses, and debt repayments. This allows for better visibility of financial commitments and can reduce anxiety related to unknown financial obligations.

-

Prioritize Debts: Identify high-interest debts and focus on paying these off first. This strategy, known as the avalanche method, can help minimize interest costs and reduce debt more efficiently.

-

Emergency Fund: Establish a small emergency fund to cover unforeseen expenses. Having a financial safety net can reduce reliance on credit and alleviate stress related to unexpected financial burdens.

-

Seek Support: Engage with debt counseling services or financial advisors for professional guidance. These experts can provide personalized advice tailored to individual financial situations, helping to develop effective debt management plans.

-

Practice Stress-Reduction Techniques: Incorporate stress-reduction techniques such as mindfulness, exercise, and adequate sleep into daily routines. These practices can help manage emotional responses to financial stress.

Implementing these tips can empower individuals to gain control over their financial situation and improve their mental health, creating a foundation for lasting well-being.

Strategies for Financial Recovery and Improving Mental Well-Being

Achieving financial recovery and improving mental well-being requires a balanced approach that addresses both financial obligations and emotional health. By adopting these strategies, individuals can work towards a more stable and fulfilling future.

1. Financial Education: Enhance financial literacy through courses or workshops. Understanding financial principles can enable better money management and informed decision-making, reducing the risk of falling into debt.

2. Goal Setting: Set realistic short-term and long-term financial goals. Having clear objectives can provide a sense of direction and motivation, contributing to improved financial health and mental well-being.

3. Utilize Resources: Access available resources such as government programs, nonprofit organizations, and community support services. These resources can offer financial assistance, counseling, and educational materials.

4. Build a Support Network: Foster connections with friends, family, or support groups who understand your financial journey and can offer encouragement and advice.

5. Regularly Review Finances: Conduct regular financial reviews to assess progress and make necessary adjustments. Staying informed about financial standings can improve control and reduce anxiety.

By integrating these strategies, individuals can create a sustainable plan for financial recovery while enhancing their mental well-being, paving the way for long-term prosperity.

The Role of Professional Help in Overcoming Debt Stress

Professional help plays a crucial role in overcoming debt stress, offering specialized support and tailored solutions to individuals facing financial hardships. Engaging with professionals can provide the necessary tools for financial recovery and improved mental health.

1. Financial Advisors: These experts help individuals create personalized budgets, explore debt repayment options, and plan for the future. Their guidance can simplify complex financial situations, reducing stress and facilitating financial recovery.

2. Therapists and Counselors: Mental health professionals can assist in addressing the emotional impacts of debt. Therapy can help individuals develop coping mechanisms for stress, anxiety, and depression related to financial situations, leading to improved mental health outcomes.

3. Debt Counseling Services: Nonprofit organizations provide free or low-cost debt counseling, focusing on negotiating with creditors, exploring consolidation options, and creating realistic repayment plans.

4. Legal Assistance: For those facing severe financial distress, legal professionals can discuss options such as bankruptcy and provide advice on navigating the legal aspects of financial recovery.

Seeking professional help encourages a proactive approach to managing debt and mental health, underscoring the importance of addressing both areas simultaneously.

Building Healthy Financial Habits for Long-Term Mental Health

Establishing healthy financial habits is key to promoting long-term mental health and avoiding future financial stress. These habits can prevent debt accumulation and foster a sense of stability and confidence in financial management.

-

Automatic Savings: Set up automatic transfers to savings accounts to ensure consistent contributions. This habit helps build emergency funds and prepares for future expenses, reducing financial anxiety.

-

Track Spending: Use tools or apps to monitor spending habits and identify areas for improvement. Understanding spending patterns can help make informed decisions and curb impulsive expenditures.

-

Limit Credit Use: Avoid over-reliance on credit by setting strict limits and paying balances in full each month. This practice can prevent the accumulation of high-interest debt and promote financial health.

-

Regular Financial Check-Ins: Schedule regular times to review financial standings, assess goals, and adjust plans as needed. Consistent check-ins support proactive management and mitigate risks of financial distress.

-

Educate Continuously: Stay informed about financial trends, tools, and resources. Ongoing education equips individuals to navigate financial decisions confidently, contributing to long-term stability and mental well-being.

Integrating these habits into daily life can create a strong financial foundation, preventing stress and supporting overall mental health.

Conclusion: Balancing Financial Health and Mental Well-Being

The intricate relationship between debt and mental health necessitates a multifaceted approach to achieving both financial stability and emotional well-being. Recognizing the psychological impacts of debt and adopting comprehensive strategies can empower individuals to navigate financial challenges effectively.

Addressing debt-related mental health issues requires both individual efforts and systemic changes. Individuals can implement personal strategies and seek professional assistance to manage stress and improve financial literacy. Simultaneously, broader societal efforts are needed to destigmatize debt and improve access to financial and mental health resources.

By fostering an environment where financial health and mental well-being are prioritized, society can create a supportive ecosystem that empowers individuals to lead balanced, fulfilling lives. Promoting awareness and understanding of the link between debt and mental health is crucial for eliminating the stigma and enhancing the overall quality of life.

Ultimately, balancing financial health and mental well-being involves a commitment to continuous learning, self-care, and leveraging available resources. As individuals take active steps towards managing their finances and mental health, they pave the way for a future characterized by stability and peace of mind.

Recap

- Debt has a significant impact on mental health, influencing anxiety, stress, and depression.

- The relationship between debt and mental health is cyclical, where each exacerbates the other.

- Real-life case studies highlight the personal impacts of debt on mental health.

- Managing debt-related stress involves budgeting, prioritizing debts, and stress-reduction techniques.

- Strategies for financial recovery include education, goal setting, and leveraging community resources.

- Professional help from financial advisors, therapists, and legal experts plays a critical role in overcoming debt stress.

- Establishing healthy financial habits supports long-term mental health.

FAQ

1. How does debt affect mental health?

Debt affects mental health by causing stress, anxiety, and depression due to financial pressure and the stigma associated with being in debt.

2. What are signs of debt-related stress?

Signs include persistent worry about finances, physical symptoms like headaches, emotional issues such as mood swings, and social withdrawal.

3. Are there global statistics on debt and mental health?

Yes, studies show individuals with high debt levels are more likely to experience anxiety or depression, with significant percentages affected worldwide.

4. How can professional help assist with debt stress?

Professional help offers tailored financial plans, therapy for emotional support, debt counseling, and legal advice for managing severe debt situations.

5. What strategies can improve financial and mental health?

Strategies include financial education, setting realistic goals, building a support network, and seeking professional advice for comprehensive management.

6. How can I build healthy financial habits?

Develop automatic savings, track spending, limit credit use, conduct regular financial reviews, and continue financial education for long-term stability.

7. Why is the link between debt and mental health important?

Understanding this link is vital to addressing both issues simultaneously, preventing a vicious cycle that can exacerbate financial and mental health challenges.

8. Can overcoming debt stress improve mental health?

Yes, managing debt effectively and reducing related stress can lead to significant improvements in mental health and overall life satisfaction.

References

-

Mind.org.uk. (2023). How Does Money Affect Mental Health? Retrieved from https://www.mind.org.uk/information-support/tips-for-everyday-living/money-and-mental-health

-

American Psychological Association. (2023). Stress in America™ Coping with Change. Retrieved from https://www.apa.org/news/press/releases/stress/2017

-

Financial Conduct Authority. (2023). Financial Lives Survey 2023. Retrieved from https://www.fca.org.uk/publication/research/understanding-financial-difficulties.pdf