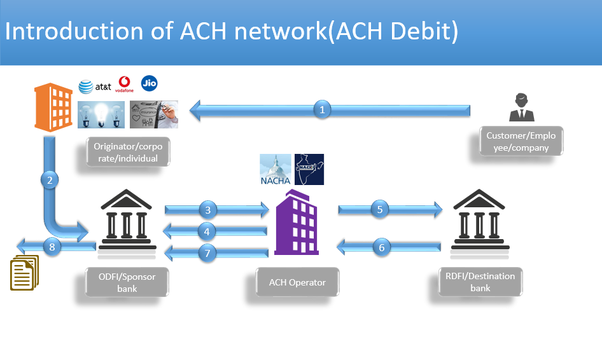

Electronic payments made through the Automated Clearing House (ACH) Network are known as ACH payments. 1 Money is transferred between bank accounts with the aid of a centralized system that routes money to its intended location. Both businesses and customers may benefit from these computerized payments because they are affordable, automated, and frequently make recordkeeping simpler.

Even though the majority of people already use ACH payments, you might not be familiar with the technical lingo. The ACH network is frequently in charge of handling payments when employers direct deposit wages or when customers pay bills online using checking accounts. According to Nacha, the Electronic Payments Association that operates the ACH network, consumers and businesses made over 23 billion ACH payments in 2018.

The fundamentals of ACH

Transfers between bank accounts via electronic means are known as ACH payments. A few instances include:

- A service provider is paid by a customer.

- An employee’s checking account receives a deposit from their employer.

- Money is moved by a customer from one bank to another.

- An organization pays a supplier for goods.

- Online donations are made by taxpayers to the IRS or regional charities.

Obtaining the other party’s bank account information is necessary for the organization requesting the payment to be completed, whether it is to send or receive funds. For instance, to set up direct deposit, an employer needs the information from workers as follows:

The name of the bank or credit union that will be handling the money.

- Either a checking or a savings account at that bank.

- The ABA routing number of the bank.

- Account number of the beneficiary.

- With that knowledge, payments can be generated and directed to the appropriate account. To pre-authorize withdrawals from customer accounts, billers require the same information.

It’s common for ACH payments to be entirely electronic. The funds, however, sometimes pass through the ACH system as merchants convert paper checks to electronic payments.

Benefits for Everyone

For a number of reasons, electronic payments are common.

- Since ACH payments are electronic, they are less resource-intensive than conventional paper checks. Check handling and depositing don’t require any paper, ink, fuel, or labor.

- It’s simple to keep track of earnings and outgoing costs with electronic transactions. Banks keep a digital record of every transaction. Tools for accounting and managing personal finances can also access this transaction history.

The benefits of ACH payments for business

Note

When using electronic payments, businesses can experience improved operations and cost savings.

Simple to handle

Businesses must wait for the check to arrive in the mail after customers pay by check, and then they must deposit the check with a bank. Payments can go missing at times, and entering those payments into a database requires a lot of work. There is no need to forward checks to the bank and wait a few days to learn which checks bounced because electronic payments arrive quickly and reliably.

Affordable Compared to Plastic

Processing an ACH transfer is frequently less expensive for businesses that accept credit card payments than accepting a credit card payment. Those savings add up, especially if you receive a lot of recurring payments. The advantages only grow when those payments are automated. However, unlike a credit card terminal, ACH does not immediately approve or deny your request.

Payments made over long distances

Although this also applies to credit cards, businesses can accept ACH payments remotely. ACH can offer a solution if your customers don’t have credit cards or would prefer not to frequently provide that information.

Why ACH Is Popular With Customers

ACH payments are advantageous to individuals as well as businesses.

Simple Payments

Consumers don’t have to write checks, order more when they run out, or mail them on time. The money comes directly from their bank account; no charges are made to their credit cards.

Autopilot

Customers do not have to watch out for bills or take any action when payments are due if using automatic ACH payments. Whatever the outcome, everything operates automatically.

How to Accept ACH Payments from Clients

You require a business relationship with a payment processor in order to accept ACH payments. You may already be in contact with one; you’re just not yet utilizing the ACH service.

Note

You can accept ACH payments from a variety of sources, so it is wise to compare them all to find the one that best suits your needs.

Ask your current service providers, such as:, if they can enable ACH payments for you as a starting point.

- The financial institution where you keep your company accounts.

- The supplier who currently handles your credit card (or other type of) payments.

- Create invoices and accept ACH payments using well-known programs from your accounting software provider.

A small business that only needs to make sporadic ACH payments may be a good fit for one of the many new payment processors that are constantly entering the market. For instance, Plooto charges a $25 monthly fee that includes ten free transfers and allows you to send or receive payments. 9 The cost of ACH may be lower for large businesses, but that price may still be competitive if you only make a small number of transactions each month.

What is the price?

Any size of business can use ACH. Higher volumes will inevitably result in lower prices, but credit card payments follow the same pattern. ACH transactions typically cost around $0.29 per transaction to send and receive. 10 The price of services may be higher for small businesses. While some include a monthly fee or take a percentage of each payment, others only charge per-transaction fees. Depending on the size of your typical ticket, those expenses might still be less expensive than the fees associated with accepting debit cards.

When weighing your options, remember to consider the big picture. Accepting checks might not be expensive, but what are the drawbacks?

Note

When you deal with paper checks, money probably doesn’t reach your account as quickly.

Setting up ACH might be more trouble than it’s worth for some businesses, such as consultants who only receive one or two checks per month and for whom cash flow is not a concern. Others, however, might benefit simply from adding more time to the day. Automating payments frees up more time for other tasks.

Individual ACH payments

If a company or other organization is on the other side of the transaction, you can send or receive payments via ACH as an individual. Direct person-to-person ACH payments are challenging to set up, but sending money when there is an intermediary is simple.

Applications developed by third parties

You can send money to friends and family for free using several apps and payment services. These apps act as a front-end for your bank account, and they frequently use ACH to process your deposits and withdrawals.

Offers from banks

You might be able to send money using a P2P payment service offered by your bank or credit union. These services might bear a bank’s logo or they might be a component of Zelle or Popmoney.

Unfortunately, entering another person’s bank details and completing a transfer are not simple for a person to do. Depending on the service you use, the recipient or sender may need to open an account with the service provider in order to complete a payment (or at the very least give the service provider their bank routing and account numbers).

Payments made on the same day

Traditional ACH payments typically take two to three business days, though weekends and major holidays can cause delays. That’s too slow in today’s on-demand society, especially for an electronic system. You can anticipate seeing quicker payments soon as same-day ACH payments started in 2016 and functionality is growing.

FAQs, or frequently asked questions

What exactly are ACH debits?

A debit is a charge made to your savings or checking account. A debit card takes money out of your bank account directly, as opposed to credit cards that use your available credit to make charges. There are numerous ways to debit your account, including through ACH debits. A sample of an ACH debit is when funds are taken out of your account through an ACH transaction.

When do ACH transactions get posted?

Although ACH transactions can be processed almost whenever, they can only be settled during regular business hours. At 8:30 a.m. on workday mornings, all transactions are settled. m. Except for same-day payments, which have three additional settlement windows between 8:30 a.m. m. and 6:30 p. m.